Advertisement

Supported by

WASHINGTON — A day after House and Senate Republican leaders said they had reached agreement on a merged version of their tax bill, they continued looking for ways to pay for the tax overhaul and faced the possible defection of a Republican senator, Marco Rubio of Florida.

Republicans plan to unveil a final bill on Friday, with the aim of voting on the legislation early next week and delivering it to President Trump for signing before Christmas.

But many of the changes made to assuage the concerns of businesses and Republican lawmakers are expected to drive up the cost of the bill and will need to be paid for to ensure the legislation does not add more than $1.5 trillion to the deficit over a decade. On Thursday, Mr. Rubio indicated he would vote no on the bill unless the expanded version of the child tax credit that he and another senator, Mike Lee of Utah, have been pushing was included. That change, which would allow families to claim the child tax credit even if they owe no income taxes, would drive up the cost of the bill even more.

“I think my requests have been pretty reasonable and consistent and direct. Right now the refundability level is $1,100, it needs to be higher,” Mr. Rubio said. “It’s a pretty straightforward ask. If the refundable portion of the child credit is substantially increased beyond the $1,100 it currently is, I’ll vote for the bill. If it’s not, I won’t.”

In an online town hall meeting on Wednesday night, Mr. Lee told constituents that negotiations were ongoing to include such an expansion in the conference tax bill.

Among the potential ideas being discussed on Capitol Hill to pay for the bill is allowing the tax cuts for individuals to expire even sooner than the 2025 date already stipulated in the Senate bill. Another idea under consideration, according to Senator Thom Tillis, a North Carolina Republican, is raising the tax rate on profits that companies have parked overseas as a way to pay for the bill.

“We’re literally trying to squeeze about $2 trillion in tax reform into a $1.5 trillion box and that’s been a problem,” Senator Ron Johnson, a Wisconsin Republican, who held out on supporting the initial version of the Senate tax bill until it gave more generous tax breaks to “pass through” businesses.

In an early morning cheer on Twitter, Mr. Trump encouraged Republicans to get the job done.

https://twitter.com/realDonaldTrump/status/941291666564141057

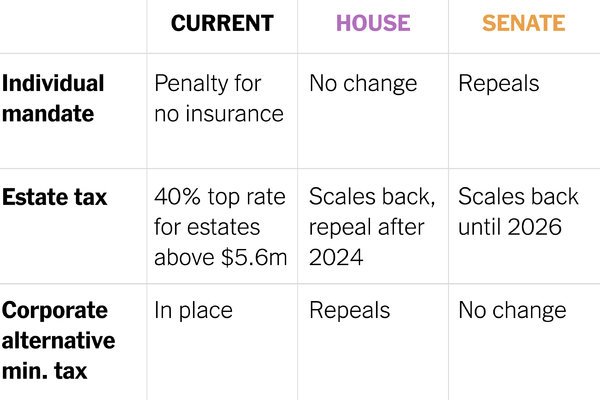

House and Senate Republicans agreed in principle on Wednesday to the framework of a consensus bill. Late changes included a slightly higher corporate tax rate of 21 percent, rather than the 20 percent in the legislation that passed both chambers, and a lower top individual tax rate of 37 percent for the wealthiest Americans, who currently pay 39.6 percent. But the bill will still scale back some popular tax breaks, including the state and local tax deduction and the deductibility of mortgage interest.

Breaking from the House bill, the agreement would allow taxpayers to continue to deduct high out-of-pocket medical expenses, and it would retain a provision allowing graduate students who receive tuition waivers to avoid paying taxes on that benefit. Also included is the Senate’s repeal of the Affordable Care Act requirement that most Americans have health insurance or pay a penalty and a provision that opens the Arctic National Wildlife Refuge in Alaska to energy exploration.

Still, the bill contains a host of tax changes that are expected to increase the cost of the bill that passed the Senate, such as repealing the corporate alternative minimum tax and increasing the income threshold at which the individual alternative minimum tax kicks in.

While the late changes to the tax bill were mean to alleviate concerns of skeptical Republicans, it was not clear how they would be paid for while still complying with the strict Senate budget rules that will allow the bill to pass without votes from any Democrats. Republicans can add no more than $1.5 trillion to the deficit if they are to pass the bill along party lines.

On Thursday, Republican leaders continued to express confidence that they were getting close to passing the most sweeping tax overhaul in decades.

“I think there’s going to be strong support in the House and Senate on this or we wouldn’t be moving forward,” Representative Kevin Brady of Texas, the Republican chairman of the House Ways and Means Committee, said on CNN.

Mr. Brady has scheduled a signing of the signature sheets for the conference report — which is the deal that’s been struck between the House and Senate lawmakers on the congressional conference committee — between 10 a.m. and noon on Friday. A majority of the House and Senate lawmakers who are on the conference committee have to sign affirmatively for the bill to move forward.

But other concerns are looming, including the health of two Republican senators, John McCain of Arizona, who is in the hospital, and Thad Cochran of Mississippi, who recently received medical treatment for health problems. Republicans, who hold a narrow 52-48 majority, can only afford to lose two senate votes, and Senator Bob Corker of Tennessee has already expressed his opposition to the bill.

Vice President Mike Pence decided on Thursday to delay a trip to the Middle East trip that he was planning to take next week so that he can preside over the tax vote in the event he needs to break a tie between Republicans and Democrats in the Senate.

Democrats have been largely sidelined in the final stages of the tax discussions.

They assailed the single public meeting of the conference committee on Wednesday as a “sham” and a “farce” and they continue to point to polls that show Republicans will likely pay for pushing tax cuts that do not appear to be popular with the general public. Democrats have also been calling on Republicans to delay the vote so that Alabama’s incoming Democratic senator, Doug Jones, has time to be seated.

“It’s the same rushed, awful process as before and it can only result in mistakes and unintended consequences that can wreak havoc on the economy,” Senator Chuck Schumer of New York, the Democratic minority leader, said on Thursday. “Every day, the more people know about the bill, the more they don’t like.”

At his weekly news conference on Thursday, Speaker Paul D. Ryan, Republican of Wisconsin, dismissed polls suggesting people are not supportive of the tax plan and predicted that the public would eventually warm to the legislation.

“Results are going to be what sells this bill, not the confusion before it passes,” Mr. Ryan said.

Sign Up for the Morning Briefing

Please verify you’re not a robot by clicking the box.

Invalid email address. Please re-enter.

You must select a newsletter to subscribe to.

* Required field

Thank you for subscribing.

View all New York Times newsletters.

An error has occurred. Please try again later.

You are already subscribed to this email.

View all New York Times newsletters.

Advertisement