In Signing Sweeping Tax Bill, Trump Questions Whether He is Getting Enough Credit

December 23, 2017 by admin

Filed under Lingerie Events

The bill was the most significant legislative victory for Mr. Trump, who has struggled during his first year in office to pass major bills that would deliver on campaign promises, even with Republicans having the majority in both chambers of Congress. Republicans promise the new tax law will benefit the middle class, but Democrats have warned that the law could be harmful to many lower-income taxpayers and to the nation’s fiscal health.

“It’s going to be a tremendous thing for the American people,” Mr. Trump said.

Before signing the legislation on Friday, Mr. Trump said in a Twitter post that companies were celebrating the bill’s passage with bonuses for workers.

Our big and very popular Tax Cut and Reform Bill has taken on an unexpected new source of “love” – that is big companies and corporations showering their workers with bonuses. This is a phenomenon that nobody even thought of, and now it is the rage. Merry Christmas!

—

Donald J. Trump (@realDonaldTrump)

Dec. 22, 2017

During the signing ceremony, Mr. Trump said, “Corporations are literally going wild over this.” A handful of companies, including ATT, which is seeking government approval of a major acquisition of Time Warner, have announced that they would give bonuses to workers.

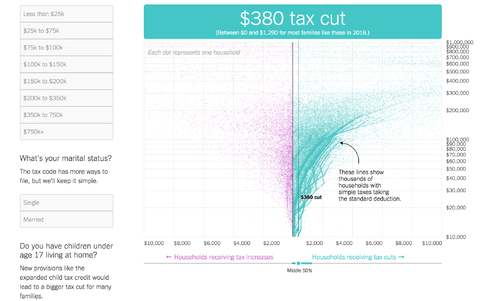

Interactive Feature

Tax Bill Calculator: Will Your Taxes Go Up or Down?

This simple calculator describes a range of tax scenarios under the Republican tax plan. Find households like yours in five steps or fewer.

There was some discussion in Congress and at the White House that Mr. Trump should consider delaying the signing until early 2018 as a way to delay automatic spending cuts that could have been triggered by the tax cuts. In addition, some companies said that delay would give them more time to adjust to the major changes that the new tax code will mean for their businesses.

However, once Congress reached a deal this week to avoid the possibility of the spending cuts, White House officials signaled that Mr. Trump wanted to sign the bill into law as soon as possible.

Mr. Trump often reacts to television news, and Friday was no different. The president delayed his travel to Florida for the holidays by an hour to stave off potential criticism.

“Every one of the networks was saying, “Will he keep his promise?’ ” the president said.

Shortly after 10 a.m., Mr. Trump announced in a Twitter post that the bill would be signed “in 30 minutes.”

Advertisement

Continue reading the main story

Earlier in the morning, the president suggested that he would not get credit for what he said were extraordinary accomplishments for a first year.

With all my Administration has done on Legislative Approvals (broke Harry Truman’s Record), Regulation Cutting, Judicial Appointments, Building Military, VA, TAX CUTS REFORM, Record Economy/Stock Market and so much more, I am sure great credit will be given by mainstream news?

—

Donald J. Trump (@realDonaldTrump)

Dec. 22, 2017

Under the new tax law, individual rates will be lowered, but those cuts are set to expire in 2025. The standard deduction, which will almost double, is likely to become more popular. The tax credit for children will also double, which Republicans have said will benefit lower-income families. The largest cut by far in the new tax law — which will not expire — benefits corporations.

The new law has been criticized by lawmakers representing states with high taxes, because the bill caps state and local tax deductions at $10,000.

The law also eliminates the Affordable Care Act’s mandate that most people have health insurance or pay a penalty. Mr. Trump has said that amounted to repealing President Barack Obama’s signature health care law, but 8.8 million Americans signed up for coverage, according to figures his administration announced on Thursday. The law is not repealed, but the mandate had been considered an important feature of it.

Mr. Trump also signed a stopgap spending bill in order to avoid a government shutdown. In addition to extending government funding, the bill includes $4 billion for missile defense, among other provisions.

Continue reading the main story