Top US general: No evidence that Islamic State leader is still alive

July 12, 2017 by admin

Filed under Choosing Lingerie

Comments Off

The latest claim is that the mastermind of the so-called caliphate he declared in parts of Iraq and Syria was killed in an air strike in Iraq’s Nineveh province.

The top American commander in the fight against the Islamic State said Tuesday that the elusive leader of the terrorist group, who has been hunted for years, may finally appear to be, well, no longer alive.

Army Lt. Gen. Stephen Townsend didn’t go so far as to say that he believes Abu Bakr al-Baghdadi is dead, but he did acknowledge in a briefing with Pentagon reporters that he has not seen evidence that he is still around.

Story Continued Below

“I really don’t know. … I don’t have reason to believe that he’s alive. I don’t have proof of life,” Townsend said — the furthest U.S. officials have gone in the wake of repeated reports that the terrorist leader has been taken out.

Reports that Baghdadi has met his demise have been numerous and unsubstantiated. The latest claim is that the mastermind of the so-called caliphate he declared in parts of Iraq and Syria was killed in an airstrike in Iraq’s Nineveh province. There were also reports in mid-June that Russia killed him in an airstrike on Raqqah in Syria.

The Tampa-based U.S. Central Command, which is responsible for U.S. military operations in the Middle East, has issued a statement saying “we cannot confirm this report, but hope it is true.” Nor has ISIS, which has a far-reaching media arm, officially confirmed Baghdadi’s death.

But Townsend’s comments suggest that U.S. intelligence is beginning to strongly suspect that Baghdadi has been a casualty of the three-year-old U.S.-led military campaign.

Many details of the elusive terrorist leader’s life remain unclear. The Islamic State leader was reportedly born north of Baghdad in 1971 and is thought to have served as a cleric in a mosque in the city around the time U.S. forces invaded in 2003. Some believe that he was radicalized during his time at Camp Bucca, a U.S. detention center in Iraq at which many now-leaders of ISIS were once held.

He served as the leader of Al Qaeda’s branch in Iraq before becoming the head of the Islamic State, making a July 4, 2014, speech on the steps of the Al-Nuri mosque in Mosul to declare the caliphate.

In December, the State Department upped the reward for information leading to the capture or death of the ISIS leader to $25 million.

It’s unclear how much influence Baghdadi has had over the command and control of the Islamic State, which has also extended its influence to other countries, such as Libya and Afghanistan.

Col. Ryan Dillon, spokesman for Operation Inherent Resolve — the U.S.-led fight against ISIS — said last month that the U.S. military does not believe Baghdadi has been able to play a role in current operations to retake the Iraqi city of Mosul or Raqqah, the group’s Syria headquarters.

Townsend said in March that nearly all of Baghdadi’s inner circle has been killed.

Yet if the terrorist kingpin is truly dead, it may not entirely be good news, said Frederick Kagan, a national security strategist at the American Enterprise Institute who has advised U.S. military commanders in Iraq and Afghanistan.

“He transformed the discussion behind the Salafi-jihadi community by declaring himself caliph. That was huge,” said Kagan, who previously taught at the U.S. Military Academy at West Point. “It changed recruiting, but it also split the movement more dramatically than any other figure I can think of.”

“He has been the driving force behind the schism between Al Qaeda and ISIS, so I think we need to recognize his passing could be a potentially dangerous moment for us because it may very well consolidate the movement under Al Qaeda leadership,” he added.

Kagan is among those who believe the United States has focused too heavily on the ISIS threat in recent years at the expense of Al Qaeda, which perpetrated the Sept. 11, 2001, attacks, and other militant groups.

“ISIS and al-Baghdadi in some respects have been a distraction from the larger Salafi-jihadi threat,” he said. “Our entire military strategy seems to revolve around killing ISIS. Al Qaeda is stronger than it has ever been in its history.”

He cited the older group’s ability to gain more popular support within the Sunni Muslim community by inserting itself into local conflicts on the side of populations that feel oppressed — and coming off as the moderate alternative to the more brutal ISIS.

“It has a much higher degree of popular support than it has ever had,” Kagan asserted. “This [killing of Baghdadi] may well have a perverse effect of strengthening Al Qaeda.”

Missing out on the latest scoops? Sign up for POLITICO Playbook and get the latest news, every morning — in your inbox.

Politico Magazine

Share and Enjoy

Amazon’s victims: These stocks have lost $70 billion so far this year

July 12, 2017 by admin

Filed under Choosing Lingerie

Comments Off

<!– –>

Market Insider

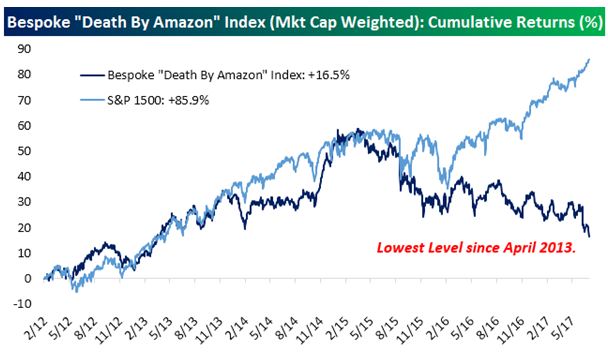

Amazon stock was lower on Prime Day and some of the retailers it has been crushing were moving higher Tuesday, but the longer-term trend shows its competitors hitting rock bottom.

Amazon’s own stock was down about 0.7 percent Tuesday, as the company offered shoppers hundreds of deals on the shopping holiday it concocted to promote its Prime membership and other products. Prime membership provides shoppers with free shipping, Amazon TV programming and other services and deals.

But Amazon, trading 2.6 percent off its all-time high, has made lofty gains compared to its brick-and-mortar rivals. For the year so far, its stock is up 32 percent, while many store chains, such as Macy’s and JC Penney, are down more than 40 percent.

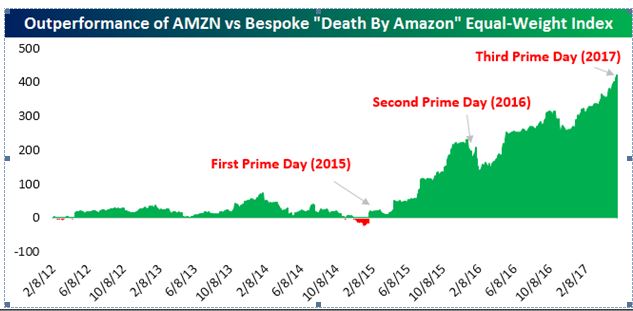

Bespoke Investment Group created an index of the major retail names it thought would be most hurt by Amazon, called “Death by Amazon,” and it was trading at a four-year low as of Monday. The index of 54 stocks is down more than 20 percent on an equal weighted basis this year. But in market cap, the group has lost $70 billion this year alone while Amazon has gained $120 billion.

Some of the 54 retailers in the index edged higher, including Macy’s, which was offering free shipping to its customers Tuesday. Kohl’s, Costco, TJX, Kroger and Target were also all slightly higher Tuesday. Rite-Aid and Walgreen Boots Alliance were lower.

Most of the stocks on the list are sharply lower for the year, with a few exceptions. HSN, which is in a merger with QVC, was up 14 percent year to date. Wal-Mart, which battled back against Amazon with its purchase of Jet.com, was up about 6 percent so far this year.

“I think [Wal-Mart] got a big bounce from that move. The Jet.com acquisition was taken as a sign the company was going to get serious about online. That was one of the reasons the stock rebounded,” said Paul Hickey, co-founder of Bespoke. “It pulled in a little, and it hasn’t regained its footing since the Whole Foods news was announced.”

Amazon announced a merger last month with grocer Whole Foods Markets, rattling retail stocks, as well as some food companies. Some of those companies were selling off Tuesday, including Kellogg and General Mills.

Analysts expect Amazon, with supermarket distribution, to affect pricing for a whole raft of packaged foods. It could also be a strong booster of the Whole Foods 365 brand, creating a bigger rival for some name brands.

“I think consumer loyalty towards brands is evaporating. … This isn’t because of Amazon for these companies specifically. Consumers don’t necessarily equate quality with these old style brands anymore,” Hickey said.

Another factor, he said, is a rally in the agricultural commodities, which means costs for cereal makers and other food companies will be higher.

As for the “Death by Amazon” index, Hickey said many more names could have been added, such as mall REITs, which have been hurt by online shopping.

But when Bespoke created the index, it chose to include only the most vulnerable retailers. The range of categories shows how broad the Amazon effect has spread. From Vitamin Shoppe to Foot Locker, Bed Bath and Beyond and Dick’s Sporting Goods, Amazon has spread pain across the retail spectrum.

Hickey said some retailers were excluded from the list because they either sold Amazon-proof products or had their own developed web strategy, like Home Depot.

Other stocks were merged away and are no longer part of the list, such as Safeway, which combined with Albertsons.

“These are the companies we think are most ‘Amazonable,’” he said. “Prime day is on 7/11, and [7-Eleven is] probably the only store that isn’t Amazonable.”

Hickey said Prime Day is a boon for Amazon, in part because of the Prime membership. “It’s the business they are building up. It’s the recurring revenues,” he said.

For other retailers, it just means future pain.

“In the U.S. retail environment, compared to other countries, there’s a ton of overcapacity in terms of square footage in stores,” Hickey said. “Until you see see some of the spare capacity worked off, it’s just not a good environment for the retail sector- and the fact that Amazon is coming after them.”

Of the stocks in the index, the worst performing year to date are Stein Mart, off 75 percent and Rite-Aid, down 71 percent. Fred’s, Tuesday Morning and Ascena Retail are all off more than 60 percent. Hibbett Sports, Zumiez, Genesco, and Smart and Final, are all down more than 40 percent so far this year.

Stocks that are down just single digits this year are Nordstrom, PriceSmart, TJMaxx, Williams-Sonoma, Costco, Big Lots and Walgreen.