Research and Markets: United States Online Lingerie Market 2015-2019 with …

January 16, 2015 by admin

Filed under Choosing Lingerie

Comments Off

DUBLIN–(BUSINESS WIRE)–Research and Markets (http://www.researchandmarkets.com/research/qgr9b7/online_lingerie)

has announced the addition of the “Online

Lingerie Market in the US 2015-2019″ report to their offering.

The analysts forecast Online Lingerie market in the US to grow at a CAGR

of 16% over the period 2014-2019

Novelty, evolving fashion landscape and rising need for comfort has

resulted in heightened demand for lingerie across geographies. The

concept of online lingerie stores with offers a wide range of

international and private labels under one platform has only further

improved the growth prospects for the lingerie industry as a whole.

One major trend in this market is the launch of online stores by top

brands such as L Brands (Victoria’s Secret) and Calvin Klein. These

online stores are more alluring and fascinating than the brick and

mortar stores. Every top brand likes to provide an online catalog for

their customers to browse easily and purchase products at their own

convenience.

According to the report, one of the key drivers of the market is

increased smartphone penetration. One of the most important advantages

of using a smartphone is that customers can check and buy goods on the

move.

Further, the report states that one of the challenges in the market is

difficulty in choosing the right product. Customers find it difficult to

buy lingerie from a brick and mortar store because availability of the

correct product can be a challenge. The online purchase of lingerie can

also be difficult, as customers do not have an option to try on the

product before purchasing.

Key Vendors

- Calvin Klein

- L Brands (Victoria’s Secret)

- La Maison Lejaby

- Lise Charmel

- Wolf Lingerie

Key Topics Covered:

- Executive Summary

- List of Abbreviations

- Scope of the Report

- Market Research Methodology

- Introduction

- Market Landscape

- Online Lingerie Market in the US: Value Chain

- Types of Lingerie

- Steps to Start Online Lingerie Stores

- Segmentation of Online Lingerie Market in US by Product

- Online Lingerie Market in US: Some Facts

- Buying Criteria

- Market Growth Drivers

- Drivers and their Impact

- Market Challenges

- Impact of Drivers and Challenges

- Market Trends

- Trends and their Impact

- Vendor Landscape

- Key Vendor Analysis

- Other Prominent Vendors

For more information visit http://www.researchandmarkets.com/research/qgr9b7/online_lingerie

Share and Enjoy

Wealthy People Make Different Choices With Their Money Than …

January 11, 2015 by admin

Filed under Choosing Lingerie

Comments Off

Per-Anders Pettersson / Getty ImagesEveryone doesn’t spend the same.

Per-Anders Pettersson / Getty ImagesEveryone doesn’t spend the same.

See Also

Building wealth and achieving financial independence is like losing weight or quitting smoking.

It is simple, but not easy.

The first requirement of building wealth is to know the difference between assets and liabilities.

Assets put money into your wallet, preferably each month. They will feed you even if you are not working.

Examples of assets include income-generating real estate, dividend-paying stocks and interest-paying bonds.

As an asset class, investment real estate has the advantage of providing rental income, appreciation and other tax advantages.

Liabilities take money out of your wallet, usually monthly. They will eat your income even if you are working.

The most common liabilities are credit cards with outstanding balances, consumer loans, home equity lines of credit, and home mortgages.

That is correct: Your home mortgage is actually a liability to you and an asset to the mortgage holder, since it takes money out of your wallet and puts it into the bank’s pocket every 30 days.

If you were to lose your job, this liability would be the one that would eat your savings the fastest.

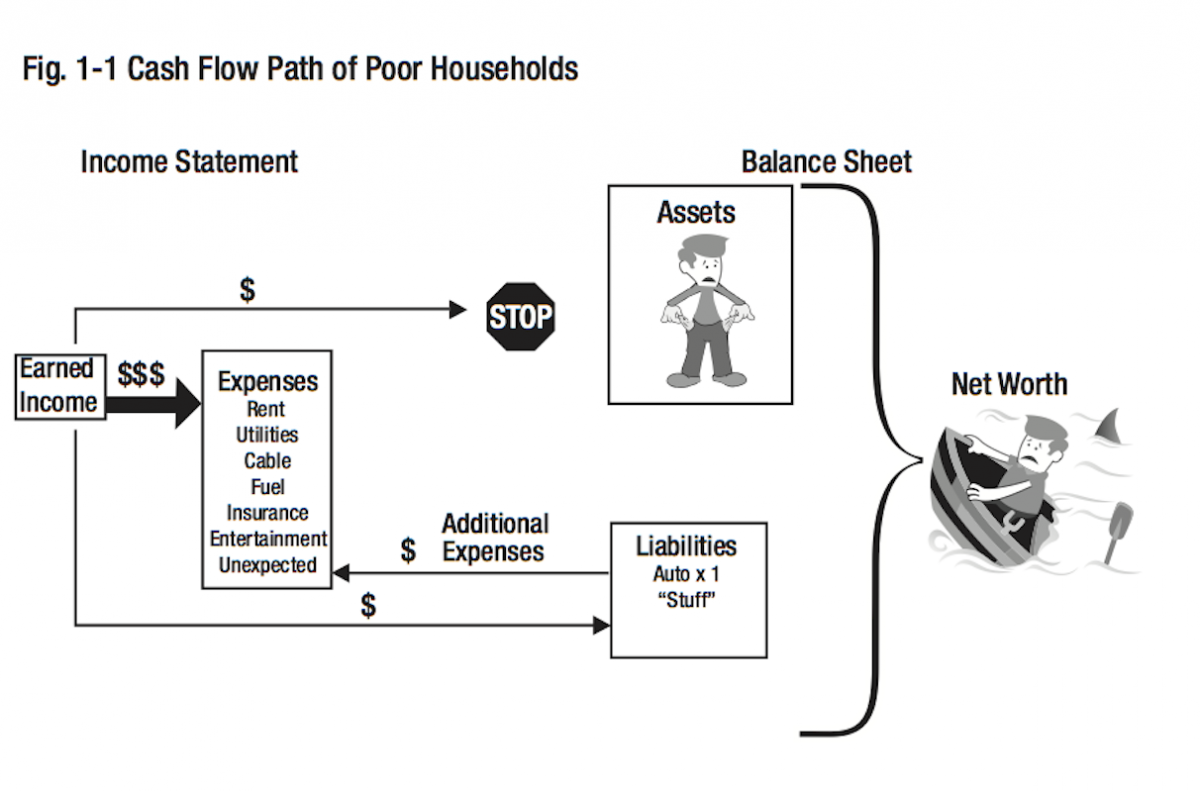

Everyone has expenses. What characterizes poor households is that almost all of their earned income flows into the Expense Box (Fig. 1).

They struggle just to maintain a roof over their heads, food on the table, and a car in the driveway. They have just a little money to put into their Liability Box and no money for the Asset Box.

Dr. Stanley Riggs

Dr. Stanley Riggs

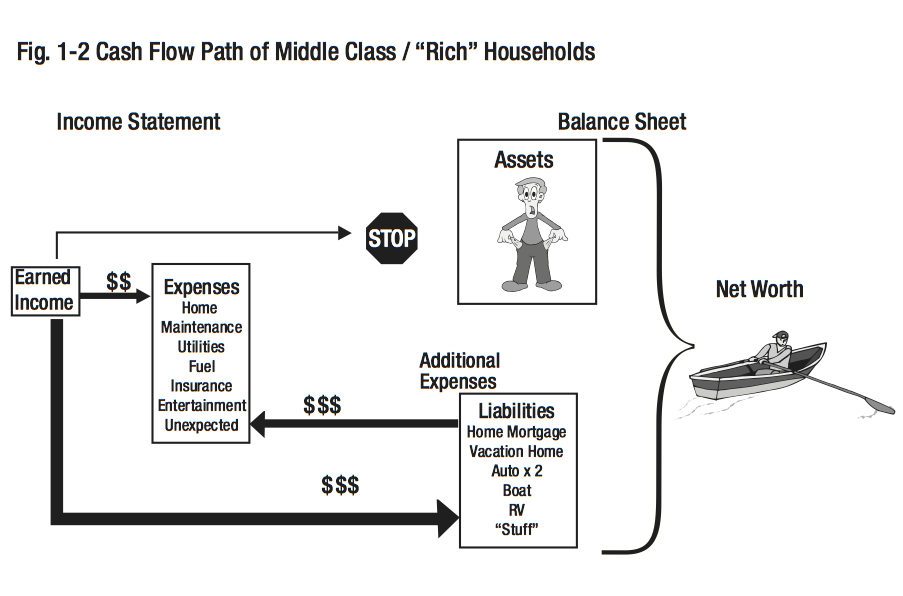

Rich and middle class households share similar cash flow patterns. Again, everyone has the basic living expenses in the Expense Box, and the middle class and rich households have proportionately higher living expenses than the poor households.

Rich people are often the successful professionals in the community and are characterized as having high-earned incomes, but usually they also have expensive lifestyles with a lot of “stuff” in their Liability Box. Although they are high earners, they often live paycheck to paycheck. Most of their cash flows from the Earned Income Box down to the Liability Box (Fig. 2).

Dr. Stanley Riggs

Dr. Stanley Riggs

But the defining characteristic is the huge amount of “stuff” in the Liability Box, which drains a disproportionately high percentage of the earned income to both buy and support those liabilities.

The second characteristic that you will notice is that, much like the poor households, neither the middle class nor the rich have money flowing into the Asset Box to generate passive income.

This is a tragic domestic cash flow. Unlike the poor, the middle class and rich do have options available to them, but every time they pull out their credit card or checkbook they just keep choosing the wrong options … they choose to put their earned money into liabilities instead of assets.

Dr. Stanley Riggs

Dr. Stanley Riggs

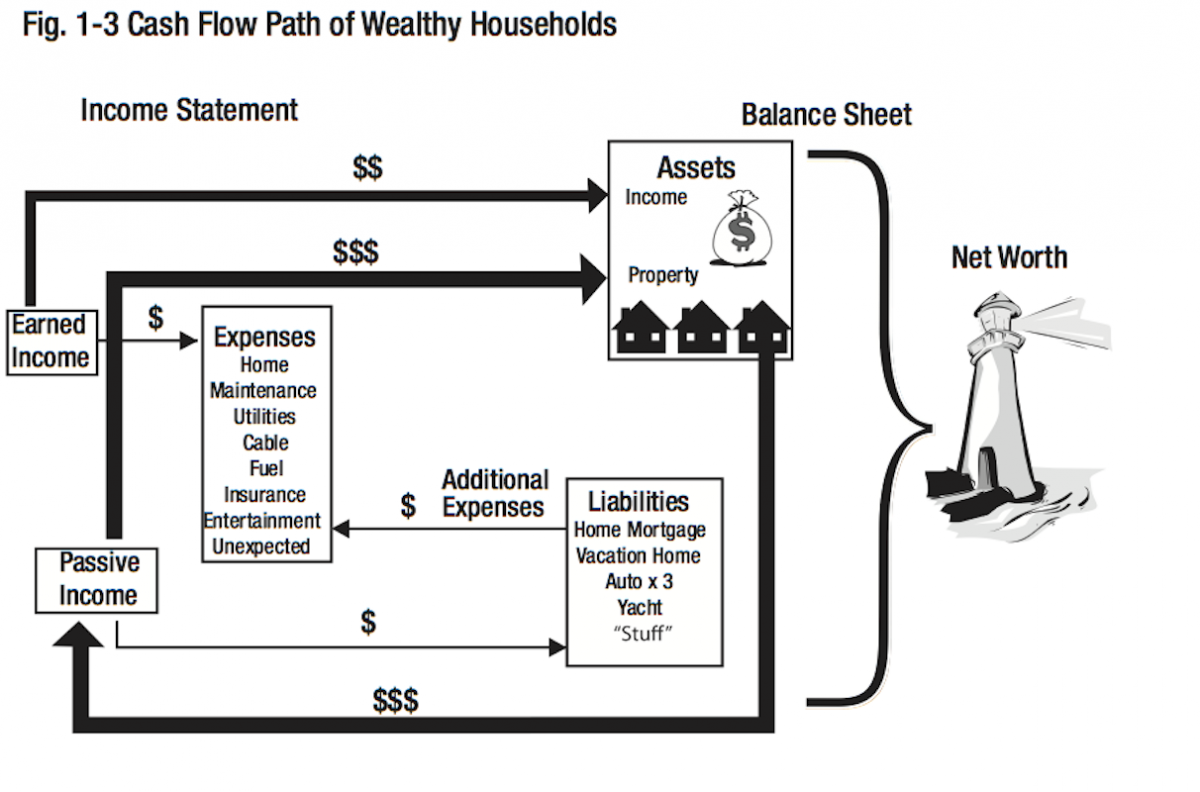

As shown in Fig. 3, the wealthy households have an Asset Box and you now see a flow of earned income into the Asset Box. So not only do wealthy households have more money flowing out of the Earned Income Box, but more importantly, they now have additional, passive income being generated in the Asset Box. Although they have more “stuff” in their Liability Box, the wealthy use their passive income rather than their earned income to support these liabilities.

Unlike the poor, middle class or rich, the wealthy households have income generators in the Asset Box, which generate passive income that can now support the living expenses, the Liability Box and, most importantly, flow back into the Asset Box to buy new income-generating assets to continuously build wealth.

What separates the wealthy from the poor, middle class and rich is this automatic feedback loop between the Asset Box and the Passive Income Box. At some level this feedback loop becomes self-sustaining, the Earned Income Box becomes unnecessary, and the household becomes truly financially independent.

So the next time you are considering buying something that will just add more “stuff” to your Liability Box, consider putting your hard earned money to work instead by using it as a down payment to invest in, for example:

- Compact rental houses

- Well-located duplexes

- Small office/warehouse industrial rental units

- Workforce or retiree mobile home parks

Your tenant’s rent should be covering the utilities, property taxes and insurance, along with paying down the mortgage, leaving you with money left over to put towards your next income producing asset.

Soon your Liability Box will be shrinking, your Asset Box will be growing and you will be building wealth and on the road to financial independence.

Dr. Stanley Riggs is the author of “Build Wealth Spend It All: Live the Life You Earned,” which shows how almost anyone can use three basic concepts to build wealth regardless of their age. While establishing and managing his private practice, he developed and managed his own commercial real estate portfolio. With his self-taught knowledge of real assets versus liabilities, economic cycles, and demographics, Dr. Riggs was able to build successful careers in the residential, commercial, industrial, and resort asset classes by staying ahead of the national economic trends. For more information, please visit www.buildwealthandspenditall.com.

SEE ALSO:

50 Ways To Build Wealth In 2015