Former DNC chair torches Clinton in new book

November 3, 2017 by admin

Filed under Lingerie Events

Comments Off

Chat with us in Facebook Messenger. Find out what’s happening in the world as it unfolds.

Share and Enjoy

Republican Plan Delivers Permanent Corporate Tax Cut

November 3, 2017 by admin

Filed under Lingerie Events

Comments Off

Representative Kevin Brady, chairman of the House Ways and Means Committee, said that the plan had the “full support” of Mr. Trump and predicted that it would be on his desk this year. Anticipating the resistance from industry groups, Mr. Brady said: “We’re going to prove them wrong once and for all.”

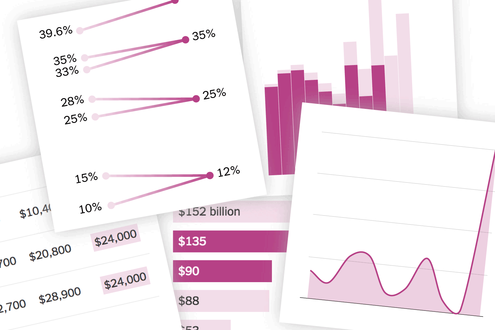

Graphic

Six Charts That Help Explain the Republican Tax Plan

The bill makes major changes to the tax code by lowering rates for individuals and corporations.

Representative Peter Roskam of Illinois, the top Republican tax writer on the Ways and Means Committee, said he was braced for the lobbyist onslaught and would not be deterred.

“We’ve just finished the opening ceremonies of the lobbyist Olympics. My phone has all kinds messages and there are all kinds of criticisms,” he said. “The notion of just defending the status quo is insufferable and we’re not going to do it.”

The bill is estimated to cost $1.51 trillion over a decade. Lawmakers must keep the cost of the bill to $1.5 trillion if they want to pass it along party lines and avoid a filibuster by Democrats. Lawmakers have been scrambling for days to find a way to make cuts that are expected to cost trillions of dollars into the existing budget hole. That has prompted a host of changes on the corporate and individual side, including repealing tax breaks for things like medical expenses, moving expenses, student loan-interest and adoption.

“This isn’t the last product,” said Representative Carlos Curbelo, Republican of Florida and a member of the House Ways and Means Committee. “This is just the kickoff to this tax reform exercise.”

Individual tax rates will change

The plan establishes three tax brackets, 12, 25 and 35 percent, and also keeps a top rate of 39.6 percent for the highest-earners, collapsing the total number of brackets from seven. The brackets fall along the following lines:

Those making up to $24,000 will pay no income tax. For married taxpayers filing jointly, earnings up to $90,000 will be in the 12 percent bracket; earnings up to $260,000 will fall in the 25 percent bracket and earnings up to $1 million would be taxed at the 35 percent rate. Those making above $1 million will fall in the 39.6 percent bracket, which is currently the top rate for millionaires. For unmarried individuals and those filing separately, the bracket thresholds would be half of these amounts, other than the 35 percent bracket, which would be $200,000 for unmarried individuals.

The bill would also eliminate the alternative minimum tax, or AMT, which is expected to hit 4.5 million families in 2017.

Advertisement

Continue reading the main story

Changes for the middle class

The proposal roughly doubles the standard deduction for middle-class families, expanding it to $24,000 for married couples, from $12,700, and setting it at $12,000 for individuals, from $6,530 today. Republicans also plan to expand the child tax credit to $1,600 from $1,000 and add a $300 credit for each parent and nonchild dependent, such as older family members, though that credit would expire after five years.

Read the Talking Points on the G.O.P. Tax Plan

Credit

Some tax credits are eliminated

The bill includes a host of changes that will impact taxpayers in different ways. For instance, it repeals certain tax credits, including a 15 percent credit for individuals age 65 or older or who are retired on disability. Right now, those individuals can claim up to $7,500 for a joint return, $5,000 for a single individual, or $3,750 for a married individual filing a joint return.

The House bill would entirely repeal that tax credit. It would also repeal the adoption tax credit, no longer allow deductions for tax preparation and repeal credits for alimony payments. And deductions for moving expenses would no longer be allowed.

No changes to 401(k) retirement plans

After much nail-biting debate, the House will not make any changes to the pretax treatment of 401(k) plans. “Americans will be able to continuing making both traditional, pretax contributions and ‘Roth’ contributions in the way that works best for them,” the talking points say.

Changing the mortgage interest deduction

One of the biggest flash points will be proposed changes to the popular mortgage interest deduction. Under the Republican plan, existing homeowners can keep the deduction, but future purchases will be capped at $500,000, down from the current $1 million limit.

The National Association of Realtors came out swinging against the bill, suggesting a huge fight awaits over how real estate is treated.

“Eliminating or nullifying the tax incentives for homeownership puts home values and middle-class homeowners at risk, and from a cursory examination this legislation appears to do just that,” said William E. Brown, president of the National Association of Realtors. “We will have additional details upon a more thorough reading of the bill.”

Mr. Howard of the home builders group said the bill is a broken promise.

“It puts such severe limitations on home buyers ability to use the mortgage interest deduction that home values will fall,” Mr. Howard said.

Eliminating the medical expense deduction

A big change may be in store for those who deduct medical expenses. The talking points outlined by Republicans say the deduction will go away but that families will be made whole by the overall lowering of tax rates and doubling the standard deduction. But those who make heavy use of the medical expense deduction — including many middle-class families — may be opposed to that change.

Advertisement

Continue reading the main story

Repealing the estate tax — eventually

The proposal will double the estate tax exemption to roughly $11 million, from $5.49 million, meaning families can avoid paying taxes on large inheritance. And it eventually repeals the estate tax altogether, phasing it out entirely in six years.

Adding limits to the state and local tax deduction

One of the biggest flash points will be how the bill treats the state and local tax deduction, which lawmakers are proposing to limit to property taxes and cap at $10,000. That will not be enough for Republicans in some high-tax states, where middle-class families make heavy use of the deduction, which currently applies to state and local income taxes and general sales taxes as well as property taxes.

House Republicans had intended to roll out the tax proposal on Wednesday, but ended up delaying its release by a day, providing a signal of the steep challenge they face in making the math work while also assembling the votes they need to get a bill through the chamber.

Representative Dan Donovan, a Republican from New York, said he remained concerned about the impact of the state and local tax deduction as he left a briefing on the bill but said he would assess the proposed changes on their entirety.

“I’m looking for a benefit for the people I represent,” he said. “The people of New York City deserve a tax break.”

Representative Tom MacArthur, Republican of New Jersey, accepted the concept of retaining the deduction for property taxes as a compromise. But he said the $10,000 cap “needs to come up a little bit.”

Document: Read the G.O.P. Tax Bill

Another New Jersey Republican, Representative Frank LoBiondo, said he would oppose the bill in its current form.

Advertisement

Continue reading the main story

Corporate rates would fall dramatically

The plan sticks to President Trump’s goal of a 20 percent corporate tax rate, down from a maximum of 35 percent today. The cut would be immediate and permanent. It also eliminates the alternative minimum tax for corporations.

Other parts of the plan would limit or eliminate some tax breaks corporations currently employ. It limits the deductibility of interest for most companies, for example, with an exception for smaller firms. It would also take away businesses’ ability to deduct some types of executive compensation above $1 million a year — including performance-based pay.

Multinational corporations face big changes

For the first time, the United States is proposing to effectively levy a global minimum tax of 10 percent, which would apply to income that high-profit subsidiaries of American companies earn anywhere in the world. The effort is aimed at preventing companies from shifting profits abroad and grabbing back some of the tax revenue on income earned overseas. Those profits are currently not taxed until they are returned to the United States, giving companies an incentive to keep that money offshore since they are taxed at the current corporate tax rate of 35 percent.

The White House has said more than $2.5 trillion in American profits are held offshore.

The bill would force companies to pay a one-time, 12 percent tax on liquid assets held overseas, like cash. The tax, which is reduced from the current 35 percent tax rate, would be payable over a period of eight years. For illiquid assets, like equipment or property, the tax rate would be 5 percent.

It would also force American subsidiaries of foreign-owned companies to pay a 20 percent excise tax on any payments sent back to foreign affiliates.

A new tax rate for pass-through businesses, with guardrails

Republicans stuck to their promise of lowering the tax rate for “pass through” businesses to 25 percent. But to prevent the rate from becoming a loophole for all sorts of individuals, tax-writers have created a formula they say will ensure that business owners will pay a higher individual tax rate on income that they receive as wages. The formula would be applied based on the circumstances of the business.

That provision is not enough to satisfy the National Federation of Independent Business, which said in a statement it is “unable to support the House tax reform plan in its current form.”

Republican leaders are encouraged

Walking into the men’s restroom, Representative Kevin McCarthy, Republican of California, said of his colleagues, “It looks very positive, these people are excited.” He added: “this is why they came to Congress.”

Continue reading the main story