How local farmers are coping with the devastating Thomas fire

December 20, 2017 by admin

Filed under Lingerie Events

Comments Off

There are no more limequats left on Mud Creek Ranch. The Kishu mandarins are crumpled and Pixie tangerines hang like lumps of black coal, but it was the avocados that suffered the most. From a distance, the fruit on a 50-year-old Fuerte tree could pass for Bosc pears, their tear-shaped avocados cooked to a caramel color. Nearby red sap oozes from the trunks of Hass and Pinkertons, as though they were bleeding.

The Thomas Fire, which as of Dec. 18 had ravaged over 270,000 acres in Ventura and Santa Barbara counties, started a quarter of a mile from Mud Creek Ranch, a 65-acre swath of land in Santa Paula Canyon where Steven and Robin Smith grow organic avocados and over 200 varieties of citrus.

It was Dec. 4 when Smith heard the dogs barking and walked out his kitchen door to find flames crawling towards his property.

“The fire was coming over that ridge right there,” he says pointing to a charred hillside. “And the wind was really howling, maybe 40 knots.”

When a second firestorm barreled down Mud Creek and ignited a neighbor’s woodpile, Smith knew it was time to go. “There were embers flying at 40 miles per hour,” he recalls. “The fire department was here but they had to bail it was too overwhelming.”

On the morning of Dec. 5, when the Smiths returned home, their barn, workshop, garage — and a historic house built in the 1880s where the Smith stored their family heirlooms — were reduced to piles of ash. An estimated 5,000 of 20,000 trees were damaged, and their house was moments away from igniting after a 40-foot tall cluster of burning bamboo had fallen onto the roof. The city’s water line was down, so Steven and his son Matthew put the bamboo fire out with their dog’s 15 gallon drinking water buckets.

The Smiths harrowing story is one of many circulating among neighbors in this farming community where residents have lost houses, vehicles, barns and entire hillside plantings as the fire cut through the steep canyons.

Fourth-generation farmer Jamie Johnson, whose properties in Ojai, Carpinteria and Fillmore all suffered fire damage, described the destruction in the area as “biblical.”

Despite his efforts irrigating, clearing the ground of dry leaf litter and bulldozing fire lines, the fire plowed into his Fillmore avocado groves on day 12 of the blaze. “It was like a freight train,” he recalls, “it was just unstoppable. You have no control and once it goes, it goes.”

This region is no stranger to fire or drought or freeze.

Ventura County holds nearly 16,000 of the state’s 54,000 acres of avocado production, more than any other region in California. About 4,500 acres are inside the burn zone, according to Farm Bureau of Ventura County Chief Executive John Krist, but the damage varies greatly from grower to grower.

“One grower I know is estimating as much 80% of avocados are gone,” Krist says. “For others it just nibbled around the edges, but it will be a few weeks before we can really get a good handle on dollar value.”

Last year, Ventura County produced 90 million pounds of avocados, and this year “we were on track to double that,” says California Avocado Commission President Tom Bellamore. Avocados are an alternate bearing crop, meaning they produce a heavy yield one year and a light yield the next. Bellamore estimates that this year’s bumper crop means that, despite the losses, it’s unlikely that customers will notice a shortage in the marketplace.

Avocados were especially hard hit because, unlike citrus which are planted on flat ground, they are often planted on hillsides, where it’s harder for firefighters to battle the flames, and it’s common practice to let dead leaves fall to the ground, where they become ready tinder in a wildfire.

While terrifying images of hillsides and palm trees ablaze have mesmerized the public, the strong Santa Ana winds fueling the fire may prove to be more damaging for farmers who are dealing with avocados blowing off the trees, rendering them unsellable, and citrus banging against the trunks and branches, which bruises the fruit and reduces its value.

“Usually a Santa Ana lasts a couple of days and you get a break,” Krist says. “For the wind to blow two weeks is just unheard of.”

The wind also spreads smoke damage, according to Ben Faber, a farm advisor with UC Cooperative Extension. “There are a lot of gases in the smoke like ethylene that is a ripening agent,” he explains. “I was out looking at a cherimoya orchard in Carpinteria on Friday, and it didn’t get hit by fire or heat, but there were a lot of cherimoyas on the ground.”

In addition to wind, smoke and fire, rows of lettuces and strawberries in the flatlands are covered in ash and the air quality in the county ranges from “unhealthy for certain groups” to “hazardous.”

Kenter Canyon Farms’ Andrea Crawford, who grows lettuces and other greens on the edge of the fire in Fillmore, questioned what would happen to her crop. “There’s a lot less sunlight,” she said by phone, and indeed, driving down Highway 150, the California sunshine appears to have been smudged out by a dirty eraser, replaced by hazy vistas and an ominous orange glow.

Tens of thousands of acres of grazing land have been charred, leaving behind a moonscape of black hillsides pockmarked with ash and brittle stumps, which worries Krist.

“Those hillsides will regenerate over time,” he says,” but if we get considerable rains this winter they are susceptible to debris flow and erosion which in the near future is a big concern.”

Back at Mud Creek Ranch, Steven Smith’s immediate concerns are tightening up irrigation systems, so they can stay on track with the crops that aren’t damaged, and talking with farm agencies about recovery.

“Everything is insured, but it’s beside the point,” Smith says. “A lot of those heirlooms, I don’t know how you put a price on that.”

Until the various agencies have assessed the farm, the Smiths have been advised not to touch anything, which means they confront a pit of ashes every time they leave the front door. And they’re left running a business without any infrastructure to pack or store fruit for their weekly farmers market hauls.

While the customers at farmers markets won’t see any drastic changes to Mud Creek’s offerings, 80% of Smith’s avocados are sold to packing houses, and after the fire, he is considering replacing many of his damaged trees with lemons which proved less susceptible to the wildfire.

Smith’s daughter Marguerita, 27, who was born and raised on the farm and continues to work in the family business, sees the loss more personally. “For us this is our life and our story. That avocado tree used to be my fort,” she says pointing to a cluster of singed foliage. “And the bamboo forest was my hide out.”

Share and Enjoy

House Passes Final Tax Bill; Senate Votes Next on Republican Plan

December 20, 2017 by admin

Filed under Lingerie Events

Comments Off

House Speaker Paul D. Ryan of Wisconsin, speaking on the House floor, called the vote “a turning point” saying “this is our chance, this is our moment.” When the bill passed the House, a giddy Mr. Ryan smiled broadly and banged the gavel with force as he declared victory.

Passage of the bill came over the strenuous objections of Democrats in both the House and the Senate, who have accused Republicans of giving a gift to corporations and the wealthy and driving up the federal debt in the process. The final vote tally can be found here.

Live: How Each House Member Voted on the Tax Bill

The House passed the Republicans’ tax overhaul bill. The bill will now head to the Senate for a vote.

Twelve House Republicans also voted no on the bill, including lawmakers from high-tax states like New York, New Jersey and California.

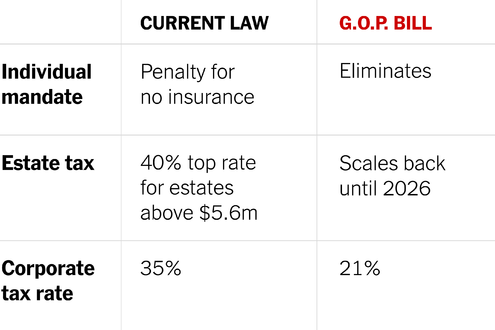

Under the bill approved by the House, the corporate tax rate would be cut to 21 percent, from the current 35 percent, a move that Republicans are betting will increase economic growth. Individuals would also see tax cuts, including a top rate of 37 percent, down from 39.6 percent. But the individual tax cuts would expire after 2025, a step that Republicans took to comply with budget rules that allow them to pass the tax overhaul using a simple majority, and without Democratic votes.

Republicans in Congress moved with remarkable speed to enact the biggest tax overhaul since 1986, unveiling legislation to rewrite the tax code, marshaling support for their effort and devising a compromise between the House and Senate in under two months.

Their success was a stark contrast with their effort this year to repeal and replace the Affordable Care Act, a quest that was encumbered by internal divisions among Republicans and ultimately ended in humiliating failure. And it gives Mr. Trump a big accomplishment as the first year of his presidency nears an end.

The action moves to the Senate

The day Republicans have been anxiously awaiting is here as they begin moving their $1.5 trillion legislation to final votes in the House and Senate. Now that the House has voted, the action moves to the Senate, which has a much narrower majority of just 52-48.

Advertisement

Continue reading the main story

The bill is expected to pass the Senate along party lines as well and Republicans scored two significant wins on Monday when Senators Mike Lee of Utah and Susan Collins of Maine said they would back the bill. With Bob Corker of Tennessee also on board, the tax overhaul appears headed to passage, even without the vote of Senator John McCain, the Arizona Republican who has returned home to receive medical treatment.

If all goes as planned and no Republicans defect, the bill should arrive on President Trump’s desk before the Christmas deadline the party has outlined.

The debate was largely a sideshow

The bill is done and dusted and while the House and Senate allow for debate on the bill ahead of the vote, it will not alter the bill’s content or trajectory.

Interactive Feature

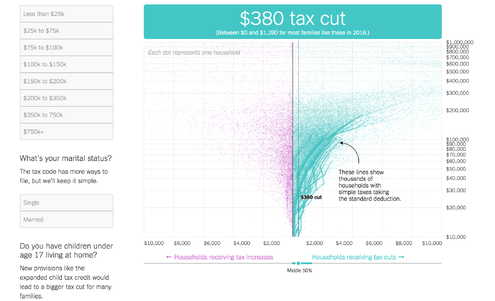

Tax Bill Calculator: Will Your Taxes Go Up or Down?

This simple calculator describes a range of tax scenarios under the Republican tax plan. Find households like yours in five steps or fewer.

Republicans are expected to continue promoting the benefits of the tax cut as helping the middle-class while Democrats will continue to assail the bill as a gift to corporations and the wealthy.

Several changes in the legislation were made late last week when the House and Senate versions were reconciled. Here is what is in the tax bill.

Corker explains his flip

Senator Bob Corker of Tennessee told The New York Times that he faced a “tough” decision in backing a tax bill that is projected to add to the deficit.

Mr. Corker had initially said he would oppose the final bill, then decided the $1.5 trillion tax cut was better for the nation than doing nothing at all.

“It’s been really tough, especially because I did think, I really felt like we could have had a bipartisan bill that would have really withstood more fully the test of time,” Mr. Corker said.

Newsletter Sign Up

Continue reading the main story

Thank you for subscribing.

An error has occurred. Please try again later.

You are already subscribed to this email.

Still, theories about his switch continue to percolate. Some suggested Mr. Corker, who has said that he will not seek re-election to the Senate, may be rethinking his political future, while others asserted that he was bought off by a late-added provision that would benefit people with large real estate holdings, including him.

Advertisement

Continue reading the main story

In an interview on Monday, Mr. Corker dismissed those theories and said he faced a wrenching decision as a Republican lawmaker with deep concerns about the country’s mounting debt and a strong desire to overhaul the tax code. In the end, he said, he put his fiscal principles aside on the assumption that the nation would be better off with the tax cuts than without.

The tax bill is still unpopular

Republicans might be preparing to celebrate the passage of their tax bill, but everyday taxpayers are not popping the champagne bottles just yet.

Fact Check: The Tax Plan

President Trump and the Republicans aim to pass their tax overhaul before Christmas. Does it deliver on their promises?

By DAVE HORN on Publish Date December 18, 2017.

Photo by Doug Mills/The New York Times.

Watch in Times Video »

A new poll from CNN and SSRS found that the tax legislation continues to be unpopular with the general public, with 55 percent opposing the proposals and 33 percent supporting them. Opposition to the bill has jumped by 10 percentage points since early November.

More people think they will be worse off after the tax bill is signed into law, and a majority of people think the tax cuts will favor the rich rather than the middle class.

The survey, conducted from Thursday to Sunday, queried 1,001 adults by landline and cellphone.

Republicans say people will learn to love the tax bill

Mr. Ryan dismissed polling that suggests the tax bill is unpopular and attributed skepticism about the legislation to pundits spreading untruths on television.

He said that he was confident that once taxpayers saw more money in their paychecks and enjoyed the benefits of a simpler tax filing system, they would learn to appreciate the merits of the tax bill.

“Results are going to make this popular,” Mr. Ryan said at his weekly news conference.

Club for Growth wanted a bigger Christmas gift

Not all conservatives are jumping for joy over the prospect of tax cuts for Christmas.

The Club for Growth said on Tuesday that the $1.5 trillion tax bill Republicans are poised to sign “falls short of pro-growth expectations.”

Advertisement

Continue reading the main story

The group wants Republicans to try again next year with a focus of lowering taxes for pass-through businesses, eliminating the estate tax completely, fully repealing the alternative minimum tax and getting rid of the rest of the Affordable Care Act’s taxes.

“There’s no reason we have to wait another 30 years to enact additional reform,” said David McIntosh, president of the Club for Growth.

What’s in the Final Republican Tax Bill

The legislation would cut taxes for corporations. American taxpayers, in large part, would also get cuts, though most of the changes affecting them would expire after 2025.

Some Republicans from high-tax states will vote no

The original House bill passed without support from 13 Republicans, including 12 from the high-tax states of California, New York and New Jersey, where constituents could see their taxes go up because of a cap to the state and local tax deduction, known as SALT. The Senate and House bills both capped SALT at $10,000 and restricted it to deducting property taxes only.

The final tax bill still contains a cap of $10,000 but allows individuals to use that deduction for property taxes as well either income or sales taxes. But the change is not expected to be enough to win over many of the Republicans who voted against the House bill given they could be vulnerable to losing their seats if constituents feel a pinch from higher taxes.

The wealthiest still benefit the most under tax bill

The final tax bill would reduce taxes on average by about $1,600 in 2018, increasing after-tax incomes 2.2 percent, with the largest benefit going to the wealthiest households, a new analysis finds.

The Tax Policy Center, which analyzed the final bill, said taxpayers in the bottom quintile, with less than $25,000 in income, would get an average tax cut of $60, or 0.4 percent of after tax income.

Those in the middle income quintile — earning between about $49,000 and $86,000 — would receive an average tax cut of about $900, or 1.6 percent of after-tax income. Those earning between $86,000 and $149,000 would see an average tax cut of $1,800 or 1.9 percent of after-tax income. Taxpayers with income between about $308,000 and $733,000, would see an average tax cut of about $13,500 or 4.1 percent of after-tax income.

Taxpayers in the top 1 percent of the income distribution (those with income more than $733,000) would receive an average cut of $51,000, or 3.4 percent of after-tax income.

While the bill has changed several times since it originally was introduced in the House and Senate, the basic financial impact remains the same, writes Howard Gleckman, a senior fellow at the Tax Policy Center.

Advertisement

Continue reading the main story

“Most households would get a tax cut at first, with the biggest benefits going to those with the highest incomes. After 2025, when nearly all of the bill’s individual income tax provisions are due to expire, only high-income people would get a meaningful tax cut,” Mr. Gleckman writes.

Continue reading the main story