Inside the play: Holder-to-snapper fake field goal seals Iowa’s upset

November 5, 2017 by admin

Filed under Latest Lingerie News

Comments Off

IOWA CITY, Iowa — Iowa long snapper Tyler Kluver weighs 215 pounds. “On a good day,” that is, he said. And he’s at least a couple inches short of 6-feet tall.

The senior from Marshalltown, Iowa, looks more like your chemistry lab partner than the guy whose reception slayed sixth-ranked Ohio State, essentially eliminating the high-powered Buckeyes from College Football Playoff contention.

“I saw it in the commercial,” Hooker said, asked if he knew of Barrett’s streak, which encompassed 22 touchdown throws. “He had a long streak and we wanted to break it. I didn’t think it was going to be that easy.”

There, too, was the targeting call on Ohio State’s Nick Bosa, which extended an Iowa drive with the game tied at 17 after a third-and-8 incompletion late in the second quarter. It left the Buckeyes without their star defensive end for the remainder of the game and led to an Iowa touchdown, then another late TD — after the first of Josh Jackson’s three interceptions — to put Iowa on top 31-17 at halftime.

But the fake field goal will live longest in Iowa lore.

“We copied it from somebody,” Ferentz said. “I’m not sure who.”

Seconds after Kluver learned of the call, Colten Rastetter, Iowa’s sophomore punter and holder, yelled for the Hawkeyes to shift into a Swinging Gate formation.

Place-kicker Miguel Recinos went in motion toward the yard-line numbers on the far side of the field in front of the Ohio State sideline, where the entire offensive line waited without the football. Defensive end A.J. Epenesa ran in motion toward Rastetter, alone in the backfield, behind four players near the line of scrimmage, including Kluver.

Urban Meyer stood near referee Ron Snodgrass. The Hawkeyes said they thought the Ohio State coach might call timeout, so Kluver snapped the ball quickly, before the Buckeyes could diagnose the fake.

Defensive end Jonathon Cooper rushed Rastetter, who shoved the ball downfield more than he threw it.

“It was a little above average,” Rastetter said of the pass.

Kluver was the only option on the play. If he wasn’t open, Rastetter was instructed not to look for another receiver. And definitely not to try to run for the first down.

“Just go down,” Rastetter said. “That’s what I was told.”

But Kluver was open, racing past linebacker Tuf Borland into clear space near the 10-yard line.

“My heart fluttered a little bit,” Kluver said.

The pass from his holder was underthrown. Kluver adjusted and made the catch.

“I’ve tried over the course of my career to show that I’m an athlete, not just a long snapper,” Kluver said with a straight face. “I’m pretty confident in my physical ability, regardless of what I was given genetically.”

Ferentz said he was more worried about the throw than the catch.

Kluver stumbled to the ground short of the goal line as Recinos, the kicker, and defensive lineman Jake Hulett raced to celebrate with him.

The long snapper said he should have scored on the play. “I’ll kick myself over it forever,” he said.

No matter, his spot in Iowa history is secure.

Share and Enjoy

Would the House GOP tax plan save a typical family $1182?

November 5, 2017 by admin

Filed under Latest Lingerie News

Comments Off

In unveiling the House Republicans’ tax bill, Speaker Paul Ryan, R-Wis., touted its positive impact for a typical American family.

“With this plan, the typical family of four will save $1,182 a year on their taxes,” Ryan said Nov. 2.

This amount is more than two-thirds lower than what the White House earlier said before the details of the House proposal were hammered out — that “the average American family would get a $4,000 raise under the President’s tax cut plan.” We have urged skepticism about the $4,000 figure.

But what about the $1,182 figure? When we took a closer look at the math, we found that it leaves out some important qualifiers.

The House Ways and Means Committee calculated several scenarios for how the proposal’s changes could affect different types of taxpayers.

The key elements in this calculation involve tax brackets, the standard deduction and the child tax credit.

Currently, there are seven brackets; these would be consolidated into four — 12 percent (up from 10 percent today), 25 percent, 35 percent, and 39.6 percent.

In the meantime, the standard deduction will be raised from $12,000 to $24,000. And the child tax credit will be increased from $1,000 to $1,600, bolstered by a new $300 credit for parents and other dependents.

The example Ryan highlighted refers to a “family of four making $59,000 per year.” Here’s the scenario outlined in the House’s fact sheet, using the fictional example of “Steve and Melinda” with two middle school-aged children:

“As a result of lower tax rates, a significantly larger standard deduction, and an enhanced Child Tax Credit and Family Flexibility Credit, Steve and Melinda will pay over $1,182 less in taxes than last year, reducing their total tax bill from $1,582 to only $400. “That’s more money they can use for whatever is important to them, whether it’s paying bills, purchasing a new refrigerator, or putting away savings for the future.”

The Ways and Means Committee, answering questions for Ryan’s office, said they chose a household income of $59,000 because it’s the median household income nationally.

For that amount of income, a family today would get $12,700 from the standard deduction, $16,200 in personal exemptions, leaving $30,100 in taxable income. Of that, $18,650 would be taxed at 10 percent and $11,450 would be taxed at 15 percent, meaning the preliminary tax liability would be $3,582.50. That would be adjusted with $2,000 in child tax credits, producing a final tax liability of $1,582.50.

Under the new tax bill, the family would take a larger $24,000 standard deduction (the proposal eliminates personal exemptions), leaving $35,000 in taxable income. At the 12 percent rate, that would mean $4,200 in preliminary liability. This would be offset by $3,200 in child tax credits and $600 in family credits, leaving a final tax liability of $400. That’s a $1,182.50 tax cut.

So Ryan has some mathematical detail to back up the figure. But it leaves out at least three caveats.

The median household income is $59,000, but the median family income is almost $73,000: The Ways and Means Committee used the figure for median household income, but Ryan referred to the “typical family of four.”

The major difference is that households can include one person living alone, whereas a family is a group of two or more people related by birth, marriage, or adoption and residing together.

So among families, a $59,000 income is not necessarily “typical” — it’s actually in the bottom half of the income spectrum. The last time the median family income was as low as $59,000 was in 1985.

On the other hand, Ryan’s office notes that if you calculate the impact the same way for a family that earns $73,000, the savings are actually higher, at $1,602.

Your mileage may vary: The GOP bill eliminates or shrinks a number of widely used itemized deductions, and those factors aren’t taken into account in the figure Ryan cited.

The deductions eliminated or pared back in the bill include the mortgage interest deduction (for future mortgages, it would be capped at half its previous maximum); the state and local tax deduction (only $10,000 in property tax deductions would be allowed); the medical expense deduction; the casualty loss deduction; and the student loan interest deduction.

Exchanging these changes for a higher standard deduction may benefit many taxpayers, particularly those who choose not to itemize today. But some taxpayers who depend on these itemized deductions today may end up worse off if the bill is passed as is, even with the higher standard deduction.

For this type of taxpayer, the loss of even one of those deductions could conceivably wipe out that $1,182 gain for certain types of families.

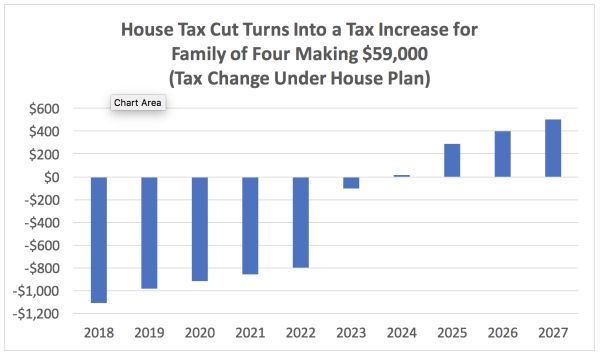

This specific amount of tax savings is good for just the first year: The benefits for this family shrink, slowly but surely, over the next decade.

“The tax cut definitely dissipates over time,” David Kamin, a tax and budget specialist at the New York University law school, told PolitiFact.

Kamin cited a combination of factors, including the sunsetting of the $300 per parent tax credit; the lack of inflation adjustments for the child tax credit, which effectively replace personal exemptions that were indexed to inflation; and the new use of an inflation adjustment measure known as chained CPI, which grows more slowly than the yardstick in current use.

According to Kamin’s calculations, the initial tax cut for the family making $59,000 becomes a $500 tax increase by 2024 compared to the status quo. Here’s the graph he put together:

Ryan said, “With this plan, the typical family of four will save $1,182 a year on their taxes.”

This is based on a plausible and transparent calculation, but Ryan glosses over some context. The calculation doesn’t factor in several itemized deductions that would disappear under the proposal and that could have a significant impact on at least some “typical” families around that income level. And Ryan’s statement is misleading when he says the family will save “$1,182 a year,” since that’s the case in the first year only; after that, the benefit starts to shrink and eventually turns into a tax hike.

We rate the statement Half True.

EDITOR’S NOTE, Nov. 3, 6:50 p.m.: This article has been updated to include additional information provided by Ryan’s office about the tax impact on a family of four that makes $73,000 annually.

PolitiFact Rating:

PolitiFact Rating: