Trump Congratulated Murdoch on the Disney Deal: DealBook Briefing

December 15, 2017 by admin

Filed under Latest Lingerie News

Comments Off

There’s a problem. Here’s what Disney’s C.F.O., Christine McCarthy, told analysts this morning:

We expect to fully realize roughly $2 billion of cost synergies by 2021.

As Andrew reminded earlier this week, “synergies” is a code word for “layoffs.” And Disney executives said that the company expects to start realizing synergies within the first year after the deal closes.

It isn’t clear yet how many jobs would be cut if the transaction succeeds, but this would be a rare deal if it actually generated new positions on balance.

— Michael J. de la Merced

But what about Fox’s bid for Sky?

Fox has a bit of unfinished business before it can go forward with its deal with Disney.

It’s in the process of seeking regulatory approval in Britain to take full control of the British satellite television giant Sky in a deal worth about $15 billion. The two companies said on Thursday that Fox plans to proceed with the acquisition and hopes to complete the acquisition of the 61 percent of Sky that it doesn’t own by the end of June.

Sky would then be wholly owned by Disney, following the closing of the Fox deal.

The context: Mr. Murdoch helped found Sky in the early 1990s and has long sought total ownership of it. He last tried to do so five years ago, but was forced to back off amid the controversy over phone hacking by British tabloids, including the since-shuttered Murdoch-owned News of the World.

Mr. Murdoch’s company had previously said that its existing stake in Sky was “not a natural end position.”

The complications: British regulators have been concerned about how much control the Murdoch family would exert over the country’s media and whether Fox, as an entity, would uphold broadcasting standards here.

Advertisement

Continue reading the main story

In June, the regulator Ofcom ruled that Rupert Murdoch and other company executives were “fit and proper” to hold broadcasting licenses in Britain, even as it also concluded that a sexual harassment scandal at Fox News had amounted to “significant corporate failures.”

Britain’s culture minister, Karen Bradly, asked the country’s competition regulator in September to carry out an in-depth review of the Sky transaction. That review is ongoing and provisional findings by the Competition and Markets Authority are expected to be released in January.

The official word: “While 21st Century Fox’s existing plans to acquire Sky remain in place, we expect the current investigation to continue,” a spokesman for the Department for Digital, Culture, Media Sport said on Thursday.

The question: Some analysts have speculated that the British government might be more comfortable with a Sky deal if Disney is the ultimate owner, but whether the Sky deal ultimately received approval remains an open question for now.

— Chad Bray

Scratch one C.E.O.’s name off a list of presidential contenders.

As part of his company’s $52.4 billion deal for Fox, Bob Iger of Disney agreed to renew his contract through 2021 to help complete the merger and integrate the new businesses.

That would seem to mean a 2020 presidential run is off the table for Mr. Iger.

In March, The Hollywood Reporter reported that Mr. Iger “had told friends he is considering their nudges that he make a run for president in 2020 as a Democrat. “

The publication added:

Iger told THR in June that “a lot of people — a lot — have urged me to seek political office” but denied he would consider a run for California governor or senator, positions that historically have served as stepping stones to the White House. However, Iger didn’t specifically address the prospect of a White House run at the time.

Here are a few other notable business people that are on the list:

• Howard Schultz of Starbucks

• Mark Cuban

• Oprah Winfrey

• Mark Zuckerberg of Facebook

— Stephen Grocer

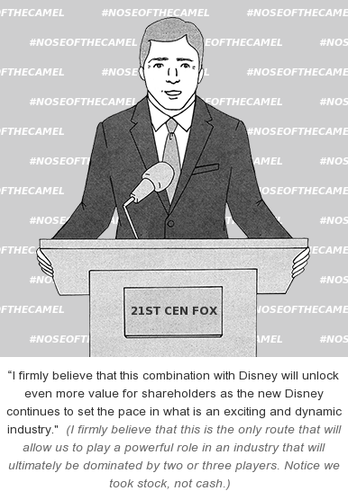

Is the Fox-Disney really done — or is 21st Century Fox now in play?

That’s the question that media executives and Wall Street bankers have been asking this morning.

Could a digital company like Amazon, Google or Apple emerge with a higher bid? Or Verizon or Comcast?

Advertisement

Continue reading the main story

Or could some of them team up to buy the assets and split them among themselves? For example, Comcast has always wanted Fox’s international assets, while any of the digital players would love to own Fox’s content business.

The Fox-Disney deal has about a $1.5 billion breakup fee if a higher bid were to emerge. If regulators block the deal, Disney would have to pay about $2.5 billion.

The Murdochs’ voting control is worth 39 percent of 21st Century Fox in most situations, except for this: If the company were up for sale, they can only vote their economic stake, which is about 17 percent. And of course, even if the deal is completed as presented today, the next chess piece that will become a point of focus is Hulu given its ownership: Disney would control 60 percent of the service, but Comcast would still own 30 percent and Time Warner owns another 10 percent.

It gets complicated quickly.

— Andrew Ross Sorkin

Of course ‘The Simpsons’ predicted this deal.

Disney announces it has reached a deal to acquire 21st Century Fox, as predicted by a Simpsons episode that first aired on November 8, 1998. pic.twitter.com/kzloJQHeM8

—

Darren Rovell (@darrenrovell)

Dec. 14, 2017

Ryan Parker of The Hollywood Reporter tweeted that one of “The Simpsons” showrunners, Al Jean, told him, “I predict people will make far too much of this mere coincidence.”

Matt Selman, an executive producer of “The Simpsons,” tweeted this:

—

Matt Selman (@mattselman)

Dec. 14, 2017

Here’s who helped put the deal together.

And, more important, how some of them will split an estimated fee bounty of up to $154 million.

For Disney:

• Guggenheim Partners

• JPMorgan Chase

• Cravath Swaine Moore

For Fox:

• Goldman Sachs

• Centerview Partners

• Deutsche Bank

• Skadden, Arps, Slate, Meagher Flom

• Hogan Lovells

• Simpson Thacher Bartlett

Here’s how much each set of advisers could collect

According to estimates from Freeman Company:

• Disney’s bankers could split between $62 million and $71 million.

• Fox’s bankers could share between $73 million and $83 million.

Advertisement

Continue reading the main story

— Michael J. de la Merced

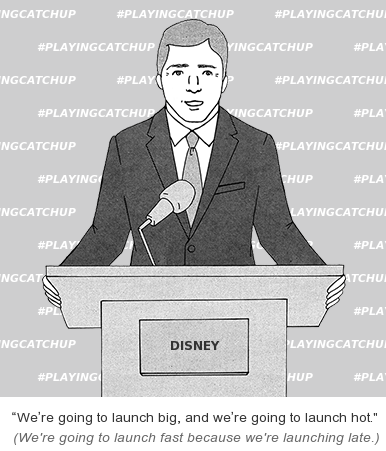

Parsing the Disney-Fox announcement.

Here’s Paul Pendergrass’s take:

Tim Cook and Charles Koch team up to defend Dreamers.

One is a tech C.E.O. who has publicly espoused socially liberal initiatives. The other is one of the most prolific and prominent conservative donors around.

But Mr. Cook and Mr. Koch have written an op-ed in the WaPo imploring Congress to give “dreamers” — the young immigrants at the center of a fight over illegal immigration — a path to staying in the U.S.

From the piece:

This is a political, economic and moral imperative. The sooner that Congress resolves this situation — on a permanent basis — the sooner dreamers can seize the opportunity to plan their lives and develop their talents.

This extraordinary set of circumstances has brought the two of us together as co-authors. We are business leaders who sometimes differ on the issues of the day. Yet, on a question as straightforward as this one, we are firmly aligned.

— Michael J. de la Merced

The latest deal to reshape the media landscape is here.

Let’s break down the Disney deal with Fox that was just announced:

• Disney will pay about $29.45 a share in an all-stock transaction, buying a big chunk of Fox businesses valued at about $66 billion, including debt.

• Fox shareholders as a whole will own about 25 percent of The Walt Disney Company.

• As expected, today’s announcement has no mention of a role for James Murdoch at Disney. That may come down the line as he negotiates with Disney.

• The Murdochs, who own about 17 percent of existing shares in Fox, will own less than 5 percent of Disney and won’t have any board seats there.

What Robert Iger of Disney has to say

We’re honored and grateful that Rupert Murdoch has entrusted us with the future of businesses he spent a lifetime building, and we’re excited about this extraordinary opportunity to significantly increase our portfolio of well-loved franchises and branded content to greatly enhance our growing direct-to-consumer offerings.

What’s at stake: Disney wants to bolster its defenses against Netflix and Amazon. The deal will give the media giant another production studio to pump out content for its forthcoming video streaming service. And Fox’s international broadcasting operations will extend its reach abroad.

A deeper dive: Ben Thompson of Stratechery takes a look at how effective a response this is to Netflix. He writes, “What has been so impressive over the last few months is the extent and speed with which Disney has seemingly figured it out — and acted accordingly.”

Behold the (probably) final G.O.P. tax bill.

• The corporate tax rate going down to 21 percent,instead of 20 percent

• The top tax rate going down to 37 percent

Advertisement

Continue reading the main story

• A $10,000 deduction that can be split between mortgage payments and state and local taxes

• A repeal of the corporate alternative minimum tax, but not the individual A.M.T.

• The repeal of the individual insurance mandate

• A preservation of tax breaks for medical expenses and tuition stipends for graduate students

• A tax deduction for pass-through businesses that largely mirrors the Senate bill’s treatment

The cost: still unclear.

From President Trump: “We’re very close to getting it done; we’re very close to voting.”

The Senate holdouts: So far, Bob Corker of Tennessee looks likely to again reject the bill on budget deficit grounds. It’s unclear whether Susan Collins of Maine or Marco Rubio are on board after having raised concerns, though neither has raised fresh objections in recent days.

The tax flyaround

• Although Mr. Trump has talked of the tax code drawing companies back to the United States from Ireland, the overhaul may make little difference with investment in the European Union country. (WaPo)

• Even as Jamie Dimon extols the benefits of the G.O.P. tax plan, banks could face higher taxes on important transactions like repo agreements. (Axios, WSJ)

• Jeff Gundlach of DoubleLine Capital warned that the tax overhaul could pose problems for the $1.5 trillion market for junk bonds. (MarketWatch)

Credit

Eric Thayer for The New York Times

The F.C.C.’s net neutrality vote is today.

You can watch the meeting here.

This is perhaps the biggest victory yet for the F.C.C. chairman, Ajit Pai, who has already opened the door for more media mergers, curtailed a high-speed internet program for low-income families and allowed broadband providers to raise rates to business customers.

Advertisement

Continue reading the main story

A useful explanation of the net neutrality changes: Geoff Fowler of the WaPo illustrates the issue using airport security lines.

Credit

Eric Thayer for The New York Times

At Janet Yellen’s last Fed meeting, a disagreement with Mr. Trump.

The Fed has concluded that Republican tax plan isn’t economic “rocket fuel,” though it will modestly improve economic growth. The regulator predicts 2.5 percent growth next year, up from 2.1 percent — but not enough to change the Fed’s plan for three rate increases next year.

When told that the president thinks the Republican tax plan could lead to growth of more than 4 percent, here’s what Ms. Yellen said:

“I wouldn’t want to rule anything out. It is challenging, however, to achieve growth of the levels that you mentioned.”

Ms. Yellen’s parting comment: “Let me emphasize that correlation is not causation.”

Looking abroad: Mario Draghi’s final European Central Bank news conference of 2017 is today. Here’s what to expect.

Credit

Daniel Leal-Olivas/Agence France-Presse — Getty Images

Parliament rebukes Theresa May on Brexit.

Any final deal on Britain’s withdrawal from the European Union will have to be submitted to Parliament as legislation before it can be put into effect. It was a defeat for the prime minister, who wanted more leeway to negotiate with the European Union.

Ms. May is scheduled to be in Brussels for an E.U. Council meeting, where the Europeans are expected to allow Brexit negotiations to proceed to discussions about trade, amid renewed questions about her authority.

On top of that, she is under pressure to explain what exactly Britain wants from an E.U. trade relationship, even though she has yet to find a consensus within her own cabinet.

From Jim Brunsden, George Parker and Caroline Binham of the FT:

“We asked the European side to leave it open for now,” said one of Mrs. May’s allies. “We didn’t want them setting down at this European Council what exactly the parameters of a deal might be.”

Extra credit: Facebook said that it found no evidence of Russian interference in last year’s Brexit vote.

Credit

Chad Batka for The New York Times

The latest in sexual misconduct news.

• Salma Hayek described how Harvey Weinstein harassed her, including by trying to shut down her movie, “Frida,” which he co-produced. (NYT and NYT en español)

Advertisement

Continue reading the main story

• Four women have accused the hip-hop mogul Russell Simmons of sexual harassment and assault. (NYT)

• The angel investor Ron Conway said that he tried to warn Hillary Clinton’s presidential campaign about getting too close to Shervin Pishevar, who now faces accusations of sexual misconduct. (Forbes)

• PBS suspended its airing of Tavis Smiley’s talk show amid an investigation into unspecified allegations of misconduct by the host. Mr. Smiley has denied wrongdoing. (Variety)

• Meet Rotten Apples, a website that tracks which movies and TV shows have ties to men accused of sexual misconduct. (NYT)

• A Netflix executive who dismissed misconduct allegations against the actor Danny Masterson, who starred in the service’s series “The Ranch,” no longer works for the company. (NYT)

• Only after an Adweek story did employees of the Martin Agency, which created award-winning ads for Geico, learn that their chief creative officer, Joe Alexander, had been accused of harassment. (WSJ)

• The documentary filmmaker Morgan Spurlock admitted to committing sexual harassment in the past and that he settled an accusation out of court. (Deadline)

• This week’s NYT Magazine explores the fallout of sexual misconduct allegations and how to move forward. And the NYT gender editor, Jessica Bennett, answered readers’ question. (NYT, NYT)

Advertisement

Continue reading the main story

Federal investigators add to Uber’s woes.

The U.S. Attorney’s office for the Northern District of California confirmed in a court filing that it has opened an inquiry into the ride-hailing giant. (We don’t know the nature of the case.)

But prosecutors told the judge overseeing the trade-secrets trial between Uber and Alphabet’s self-driving car company that Uber hasn’t produced some evidence relevant to that court fight.

The next step: A letter from a former Uber security employee, accusing the company of secretly surveilling competitors, is expected to be released, in a redacted form, by the court on Friday.

Credit

Doug Chayka

The tech flyaround

• Farhad Manjoo writes in his latest State of the Art column: “Tech giants began to grudgingly accept that they have some responsibility to the offline world. The scope of that responsibility, though, is another matter entirely.” (NYT)

• A look at how the Philippine government under Rodrigo Duterte uses Facebook to push back against critics. (Bloomberg Businessweek)

• Why investment management giants like Fidelity are racing to keep up with Silicon Valley. (Bloomberg)

• Target agreed to acquire Shipt, a same-day delivery service similar to Instacart, for $550 million in effort to keep up with Amazon. (Recode)

• Apple agreed to invest $390 million into Finisar, the maker of a key component in the iPhone X, to lock up an important parts manufacturer. (Axios)

Advertisement

Continue reading the main story

• Microsoft’s new partners in A.I. include Reddit and UPS. And Google has established an A.I. center in China. (Axios, NYT)

Revolving Door

• UBS hired Martin Blessing, the former C.E.O. of Commerzbank, as the head of its wealth management unit, marking him as a contender to become the Swiss bank’s next chief. (FT)

• UBS also hired Chris Cormier from Bank of America to run its tech, media and telecom equity business in the Americas. (Reuters)

• Blackstone has hired Atsuhiko Sakamoto from Bain Capital to build out a leveraged buyout team in Japan. (Reuters)

The Speed Read

• A major union has won significant job protection and increased pay for about 20,000 ATT wireless employees. The union has offered to help make the case for the company’s proposed acquisition of Time Warner. (NYT)

• Walmart is trying to ease some of the financial strain on its workers by allowing them to receive wages before their next payday, but labor groups say that the company should be paying its employees more. (NYT)

• Atos is continuing its unsolicited bid to buy the security software maker Gemalto even after the company’s board unanimously rejected the $5.1 billion offer. (Bloomberg)

• When N.F.L. owners signed off on Roger Goodell’s five-year extension, they were looking for continuity. (NYT)

Advertisement

Continue reading the main story

• China has put Jia Yueting, a tech tycoon, onto an official online blacklist of credit defaulters, which means he can be blocked from flights, high-speed trains and big purchases. (NYT)

• Kingdom Holding Company, Prince Alwaleed bin Talal’s investment firm, has become a black hole of information, and all meaningful activity has been suspended in his absence, according to bankers. (FT)

• The rise of economic nationalism is clashing with the open-market ideals of the European Union’s founders and affecting products from Italian chocolates to German faucets. (WSJ)

• Bitcoin made Michael Poutre, chief executive of Crypto Company, one of the richest men in the United States, briefly. “It is yet another sign of the extraordinary popular delusion being created by Bitcoin and the rush for everything crypto,” writes James Mackintosh. (WSJ)

• Tesla is “headed for a brick wall,” according to Jim Chanos of the hedge fund Kynikos Associates. (Bloomberg)

Want this in your own email inbox? Here’s the sign-up.

You can find live updates throughout the day at nytimes.com/dealbook.

Follow Andrew @andrewrsorkin, Michael @m_delamerced and Amie @amietsang on Twitter.

We’d love your feedback as we experiment with the writing, format and design of this briefing. Please email thoughts and suggestions to bizday@nytimes.com.

Continue reading the main story

Share and Enjoy

Firefighter killed battling Thomas fire as massive blaze moves toward Santa Barbara

December 15, 2017 by admin

Filed under Latest Lingerie News

Comments Off

Fire officials confirmed Thursday that a firefighter died while battling the Thomas fire, which ranks as the fourth-largest in the state’s modern history.

“I am very saddened to report that a firefighter fatality has occurred on the Thomas Incident,” Chief Ken Pimlott, the director of the California Department of Forestry and Fire Protection, said in a statement. “Please join me in keeping our fallen firefighter and his loved ones in your prayers and all the responders on the front lines in your thoughts as they continue to work under extremely challenging conditions.”

Pimlott said the victim was a Cal Fire engineer from the San Diego unit. Details about the firefighter’s death were not immediately available.

“IMT 4, CAL FIRE Local 2881 and Southern Region leadership are working to support the Unit and his family, who have been notified,” Pimlott said.

There will be a news conference at 6 p.m.

Despite a couple of days of reduced winds and feverish efforts by firefighters to establish new containment lines, the 242,500-acre Thomas fire has surpassed the size of the Zaca fire, which scorched Santa Barbara County in 2007, according to Dave Zaniboni, a spokesman for the Santa Barbara County Fire Department.

Firefighters hope the 240,207-acre Zaca fire burn scar, as well as the younger vegetation it contains, will help them fight the Thomas fire’s growth along its western edge.

Firefighters have taken advantage of a two-day lull in winds to increase fire containment to 30%. Those efforts could be tested soon, however, as forecasters predict a new blast of Santa Ana winds Thursday, and sundowner winds over Santa Barbara County on Friday.

In Thursday’s incident report, fire officials said they didn’t expect to reach full containment of the blaze until Jan. 7 — more than three weeks from now.

The state of California began keeping records of wildfire acreage in 1932. While other large fires raged on the West Coast prior to that year, those records are less reliable, according to the California Department of Forestry and Fire Protection.

At a morning briefing Thursday, fire commanders said another day of extremely low humidity and moderate winds would greet firefighters as they continued to build containment lines above Carpinteria, Montecito and Santa Barbara.

The mountains north of the coast produce notoriously unpredictable and dangerous conditions for firefighters, said fire behavior analyst Tim Chavez. In the Matilija wilderness, which straddles the border between the two counties, observers saw 50-foot flames backing down a hillside overnight, he said. It’s unusual to see flames that tall working their way down a mountain, officials said.

“This thing is 60 miles long and 40 miles wide,” Chavez said of the blaze. “There’s a lot of fire out there.”

Gusty Santa Ana winds are expected for Los Angeles and Ventura counties Thursday, said Stuart Seto, a weather specialist with the National Weather Service. In the mountains, gusts of 55 mph are possible.

In the valleys, 15 to 25 mph gusts are predicted, with some gusts of up to 40 mph, Seto said. Over the past few days, a break in the weather has allowed firefighters to increase containment.

“That’s the thing, it’s just going to do the opposite now. The humidities are still down in the single digits,” Seto said. “These winds, especially in the mountain areas, are really going to start blowing the fire around again. What it does is carry the embers further down and can create more fires.”

Winds will be north to northeast, and usually the Ventura side is more affected than the Santa Barbara side, Seto said.

“But it’s still going to have an effect up in the mountain areas of Santa Barbara,” he added. Winds up there will be up to 25 mph and a little gusty, “so there’s still going to be a big concern up in that area,” he said.

Throughout mountain areas on Thursday there’s a greater risk for large fire plumes, which can cause erratic fire behavior.

“It carries the heat up, and it looks like a thunderstorm cloud,” Seto said. “From there, the fire could spread out. Sometimes they collapse, and it’s a strong down-rush of winds and it spreads the fire.”

Sundowner winds are expected Friday into Saturday in the Santa Barbara area. On Sunday, winds are expected to return to offshore conditions, Seto said.

The fire has destroyed more than 900 homes in Ventura and Santa Barbara counties since it began Dec. 4 near Thomas Aquinas College in Santa Paula. In its first day, the fire spread southwest, toward Ventura, and northwest, eventually hugging Ojai before pushing to the Central Coast.

CAPTION

Walt Disney Co. plans to buy much of the media assets of Rupert Murdoch’s 21st Century Fox. Five more women accused Russell Simmons of sexual misconduct. Republican leaders agreed on a revised plan to cut taxes. Jurors voted for a death sentence for Isauro Aguirre.

Walt Disney Co. plans to buy much of the media assets of Rupert Murdoch’s 21st Century Fox. Five more women accused Russell Simmons of sexual misconduct. Republican leaders agreed on a revised plan to cut taxes. Jurors voted for a death sentence for Isauro Aguirre.

CAPTION

Walt Disney Co. plans to buy much of the media assets of Rupert Murdoch’s 21st Century Fox. Five more women accused Russell Simmons of sexual misconduct. Republican leaders agreed on a revised plan to cut taxes. Jurors voted for a death sentence for Isauro Aguirre.

Walt Disney Co. plans to buy much of the media assets of Rupert Murdoch’s 21st Century Fox. Five more women accused Russell Simmons of sexual misconduct. Republican leaders agreed on a revised plan to cut taxes. Jurors voted for a death sentence for Isauro Aguirre.

CAPTION

The bold bet by Disney will transform Hollywood, but how the two companies will merge is a big question.

The bold bet by Disney will transform Hollywood, but how the two companies will merge is a big question.

CAPTION

Democrat Doug Jones won Alabama’s U.S. Senate seat Tuesday. A cooking fire at a homeless encampment caused the Skirball fire, officials said. San Francisco Mayor Ed Lee, 65, died Tuesday. House Democrats called for an investigation into allegations of sexual misconduct by President Trump.

Democrat Doug Jones won Alabama’s U.S. Senate seat Tuesday. A cooking fire at a homeless encampment caused the Skirball fire, officials said. San Francisco Mayor Ed Lee, 65, died Tuesday. House Democrats called for an investigation into allegations of sexual misconduct by President Trump.

CAPTION

Democrat Doug Jones, whose uphill bid for U.S. Senate gathered strength when Republican Roy Moore was hit with charges of sexual misconduct with teenage girls, won Alabama’s special election Tuesday.

Democrat Doug Jones, whose uphill bid for U.S. Senate gathered strength when Republican Roy Moore was hit with charges of sexual misconduct with teenage girls, won Alabama’s special election Tuesday.

CAPTION

New York City’s bomb attack suspect was allegedly inspired by Islamic State’s call for attacks. The Thomas fire has grown to at least 230,000 acres. ”The Shape of Water” and “Big Little Lies” led the Golden Globe nominations anounced Monday. Mario Batali stepped away from “The Chew” and his day-to-day business operations.

New York City’s bomb attack suspect was allegedly inspired by Islamic State’s call for attacks. The Thomas fire has grown to at least 230,000 acres. ”The Shape of Water” and “Big Little Lies” led the Golden Globe nominations anounced Monday. Mario Batali stepped away from “The Chew” and his day-to-day business operations.

brittny.mejia@latimes.com

Twitter: @Brittny_Mejia

ALSO

‘This fire is a beast’: Massive inferno keeps growing despite epic battle by firefighters

Witnesses saw snapped, sparking power line at start of destructive L.A. wildfire

Track the key details on Southern California’s fires

Wealthy Bel-Air wrestles with homeless crisis after encampment fire burns homes

UPDATES:

1:00 p.m.: This article was updated with additional details about the death of the firefighter.

12:45 p.m.: This article was updated with the death of a firefighter.

10:04 a.m.: This article was updated with details on Cal Fire wildfire records.

9:55 a.m.: This article was updated with details on homes destroyed and an expected containment date.

This article was originally published at 8:50 a.m.