Can Procter & Gamble Find Its Aim Again?

June 11, 2016 by admin

Filed under Choosing Lingerie

CEO succession is a complex, often messy endeavor. Just ask the board at Disney,

dis

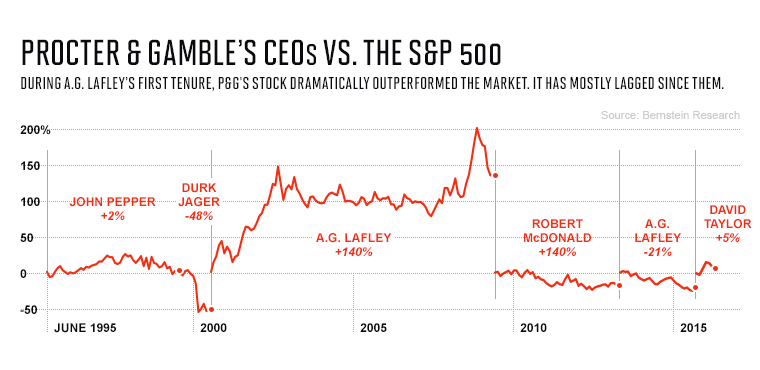

which has struggled to identify a future replacement for CEO Bob Iger, or those duking it out with 93-year-old Sumner Redstone for control of Viacom (read more about that in our feature “Here’s What’s Really Going on Inside the Fractious Battle for Viacom“). That was not the case at PG back in 2009, when Lafley, who had presided over a decade of dramatic innovation and renewal, as well as the company-doubling $57 billion acquisition of Gillette in 2005, prepared to step down.

Talent management and succession planning was something that PG, the ultimate promote-from-within company, considered among its greatest competitive advantages. One of its biggest trade secrets wasn’t a clothes-cleaning technology or diaper formulation, but its Talent Portfolio, a blue binder that listed pertinent data on every candidate for the top 120 jobs—as well as their potential replacements several levels down. In 2009 I got a peek inside that binder as I reported extensively on the carefully calibrated process that elevated then-COO McDonald to succeed Lafley.

But as impressive as the method was, the result was a bust. In fairness, McDonald had the misfortune of taking over during the punishing global recession that followed the financial crisis. But he proved to be a divisive leader. And he set out so many goals that few could grasp the real priorities. He also lacked a strong chairman, a PG hallmark. Lafley served as chairman for just six months before resigning and leaving McDonald to his own devices.

Too many of the decisions during Lafley’s first tour as CEO—heralded at the time—turned out to have complicated aftereffects. The company’s emphasis on premium products in North America, such as Olay’s higher-end skin creams, left it exposed when purchasing power dropped during the financial crisis. Lafley’s decision to consolidate more power in “global business units” left long-powerful brand and country managers struggling to apply local insights.

“Innovation” came to mean modest twists on existing items (think Pantene for curly hair, medium-thick hair, Heat Shield, and Ice Shine) rather than new ideas. Says Werner Geissler, PG’s former vice chairman: “RD people were working too much on cosmetic upgrades as opposed to game-resetting innovations. Head Shoulders with Apple? Seaweed?” (In case you’re wondering, PG did sell both versions.)

A.G. Lafley (right, in 2009) oversaw a smooth transition to Robert McDonald but then returned to replace his successor after McDonald struggled.Photograph by Greg Miller

A.G. Lafley (right, in 2009) oversaw a smooth transition to Robert McDonald but then returned to replace his successor after McDonald struggled.Photograph by Greg Miller

And the seemingly logical move into developing markets—where the rising middle class meant billions in new consumer spending—proved more volatile than anticipated. It was this move that defined McDonald’s tenure: In 2011 he announced that PG would have 800 million new customers by 2015, primarily in China, Russia, and other newer markets. “The move of the center of gravity is critical,” he said at the time.

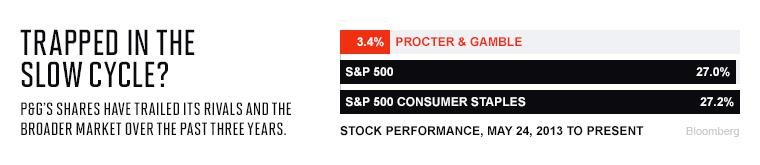

It never happened. Instead, PG posted a string of sales and earnings disappointments. The result: a falling stock and unhappy pensioners (whose retirement was paid in stock) who actively campaigned for McDonald’s removal. That occurred as activist investor Bill Ackman took a stake and publicly denounced McDonald’s leadership. A slow-moving political bureaucracy, it seemed, had lost its way.

On May 23, 2013, McDonald suddenly “retired” from PG. Back came Lafley, then nearly 66. Having remarried and moved to Florida to pursue triathlons and a part-time private equity gig, he found himself again at the company he had left so triumphantly. PG’s board believed he was the only person who could dig the company out of its hole. Apparently, PG’s blue binder didn’t have as much top talent as its heft had implied.

But A.G. 2.0 turned out to be more of a brand extension than a breakthrough innovation. This version of the CEO was older and less energetic, one who defined his job more narrowly than he had the first time around. Once an indefatigable traveler who evangelized about the customer’s “first and second moments of truth,” Lafley stayed behind the scenes this time, using his newfound private equity skills to figure out which brands and categories deserved focus and which should be jettisoned. He announced he would no longer speak on quarterly earnings calls, refused to interact with the press, and, despite the fact that China was one of the company’s biggest trouble spots, visited there only twice in his 2½ years at the helm. He wasn’t even willing to move back to Cincinnati. That meant a PG jet flew him back to Florida every weekend, at a cost of $512,000 in 2015 alone.

Once driven by passion, Lafley now seemed motivated by obligation—as well as, perhaps, a desire to preserve his legacy. As he told an audience at UCLA’s Anderson School of Management in December when asked why he came back: “The short answer was duty and unfinished business.”

Lafley set about, in some cases, undoing actions he himself had taken years before. In 2014, PG announced it would sell what turned out to be 116 of its 166 brands—a housecleaning that included several acquisitions championed by Lafley himself, such as Wella, bought for $7 billion in 2003, and Clairol, for $5 billion in 2001. In 2015, Coty agreed to buy the two, along with 40-odd others, for $12.5 billion. Duracell, which came with the Gillette purchase in 2005, was sold to Warren Buffett this year. (The Oracle of Omaha traded his 52 million PG shares for the battery business, a seeming vote of no confidence in PG’s overall prospects.)

Lafley, and later Taylor, began recalibrating the company’s strategy in China. PG had entered early, in 1988. But it underestimated the growth of China’s upper class, focusing instead on the lower- to middle-class market. Its diapers, for example, proved vulnerable to higher-end offerings from Japanese competitors; PG’s market share has fallen nearly five percentage points since 2010, to 37%, according to Euromonitor Citi Research. Explained Taylor at a recent conference: “We looked at it too much like a developing market as opposed to the most discerning customers in the world.” PG is now trying to move upmarket in China.

PG has also shifted more resources back to North America, where it has a more dominant share. And it has become leaner and less bureaucratic, in part through huge job cuts—35,000 by the end of 2016. PG has slashed product categories from 15 to 10 to improve focus. Says Jon Moeller, its longtime CFO: “The businesses we are keeping are those where we have a product technology that makes a consumer difference—and, almost to a one, daily use items.”

When asked about reversing his own much-lauded strategy, Lafley was unapologetic: Different times require different measures. As he told the audience at the Anderson School (Lafley declined to be interviewed for this article): “I had two incredibly interesting opportunities, and they were 180 degrees different. In 2000 the job was to grow. It was an extension and expansion strategy. When I came back,” he said, “I looked at a company that was overextended and overexpanded … It was a totally different situation.” Left unsaid was the question of whether one strategy might have had anything to do with the other.

After just over two years, Lafley concluded he was done, again. He hadn’t revived top-line growth, but he had made tough decisions and, he felt, refocused the company. Lafley announced he would move to executive chairman in November 2015—to be replaced as CEO by Taylor, then the group president for global beauty, grooming, and health care. The board conducted a search but ended up choosing—again—a lifer carefully groomed by Lafley. (In another Groundhog Day moment, Lafley announced on June 1 that he will resign as chairman again on July 1. This time he stayed eight months rather than six.)

Internally, there was a collective sigh of relief. Taylor, many thought, could provide both stability and a higher level of engagement than the company had experienced of late. Taylor is known as a good guy—the type who trusts his lieutenants, inspires people, and bleeds PG blue and white.

He began as a plant engineer. But 12 years in, he decided he wanted to work with the brands and started over again from the bottom as an assistant brand manager for Pampers—an unusual move and one that required humility. Says Gary Martin, PG’s former head of family care, who ran product supply when Taylor was a plant manager: “He was always a star. I managed 65,000 people, and every time we rated the most promising people, he was always No. 1.”

Taylor is white, North Carolinian, basketball-loving, churchgoing—straight out of central casting for the PG executive suite, if not exactly an improvement on the diversity front. He has worked in beauty, grooming, and fabric care on multiple continents, but spent most of his time in the baby-care business. An operations guy rather than a marketer, Taylor won kudos for successfully expanding the paper business into Europe and, later, advocating the sale of the pet-care business.

Unlike some predecessors, Taylor is said to make people feel comfortable. But is feeling comfortable what PG needs right now? “I find [Taylor] to be absolutely lovely,” says veteran Citigroup

c

analyst Wendy Nicholson. “But when you talk to him he talks a lot about the high level: ‘We care about the consumer and culture.’ You wonder if that makes folks feel better, but maybe it’s not the right approach.”

Taylor says he understands such criticism, but responds, “I’m in a great position because I understand that culture.” There have, of course, been secret rebels who entered as seemingly rote company men only to smash the china. Intel’s

intc

Andy Grove was the clear exemplar, and GM’s

gm

Mary Barra and Microsoft’s

msft

Satya Nardella are attempting similar transformations. But so far, it’s hard to imagine that this earnest red-haired guy with 36 years at the company is a secret revolutionary in a plaid jacket.